Sept. 14, Pre-market Observations

September 13, 2021

I have a few comments and observations on yesterday’s action, and what I am looking for this morning. Since miners technicals closed in the mid-range, neither overbought or oversold, there shouldn’t be any trade signals for at least the first hour of trading. However, some interesting developments are starting to fall into place so lets get into it.

First, the mining sector was strong today for the first time in awhile, and was able to build on gains throughout the day, only pulling back a little about a half-hour before the close. Better, the miners were gaining ground mid-day when the stock market started to sell off. This is important because many are afraid to touch miners before a stock market decline they see as inevitable. It doesn’t necessarily have to play out that way, and action like today’s suggest miners might be the direct and immediate beneficiary of money leaving stocks. Another positive is that the mining sector was up while the metals themselves were flat or lower on the day. Lastly, I saw trades occurring that are not typical lately, like somebody taking 300 SILJ LEAP call options, the buy cost roughly $75K and all were at the offering price meaning the buyer was not willing to wait for a better price. Of note, this was not a day trade, as the volume only reached 320 or so contracts by the end of the day, the buyer held overnight.

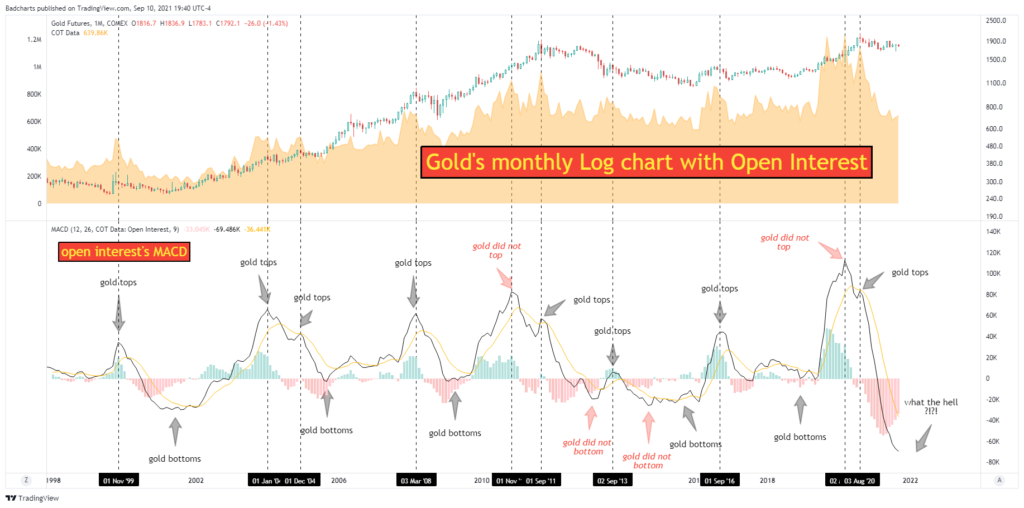

We weren’t super active as we are already loaded up and ready, but still saw a few opportunities to add to SILJ, IRVRF, and GDXJ and took advantage. GDXJ had a very good day, up over 4%, and the type of move we look for when making a turn that will stick. It was good to see all the miner etf and indexes we follow close above their 200 MA’s on their half-hour bar charts, a necessary prerequisite to initiate a new uptrend. Lets look at a few charts, one of mine, and also a couple from Patrick Karim, a silver and gold analyst with some interesting charts he posted on his Twitter channel that does some great work with the long term outlook in the sector.

So things look good for tomorrow. We also should have time to watch things unfold in the morning before getting any buy signals in the mining sector. As far as other setups in things like the KWEB etf, we will examine them and mention if there is anything we might buy or add to in the morning, but for now our major focus remains on the precious metals sector and their miners in particular. Especially the etfs at this point as they are the safest play (SILJ, GDXJ, GDX, etc) until the group really gets moving higher.