Stopped out of two miners, added to NOVRF

July 19, 2021

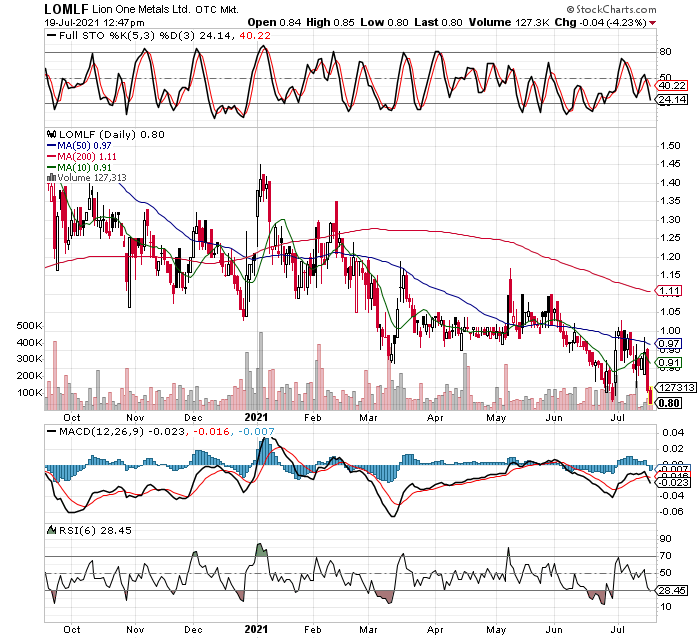

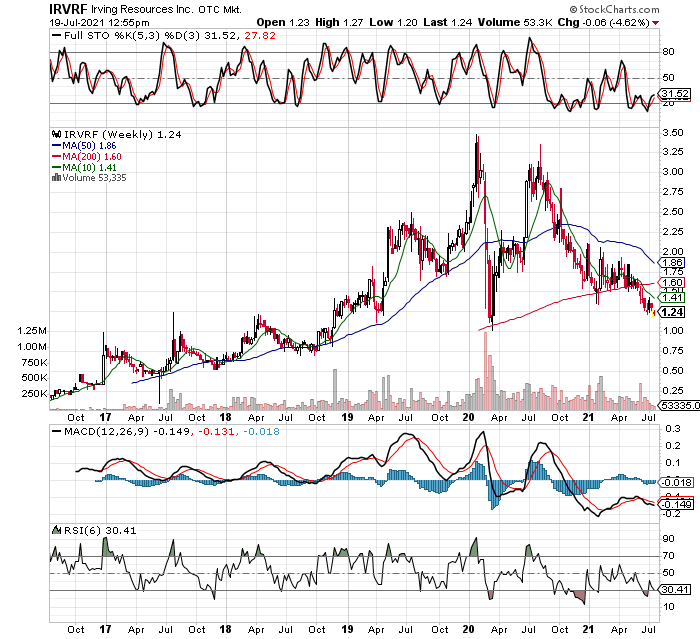

With the relentless beating the miners have taken since the FOMC meeting a few weeks ago, I have been stopped out of two more positions. I don’t like it, but we have trading rules for a reason, and more often than not I end up being happy I stopped out when the stock reached my limit. This morning, Irving Resources (IRVRF), and Lion One Metals (LOMLF) were jettisoned. I hate to see LOMLF sold, being on the weekly chart its coming down to its 200 day MA, but again, we must adhere to our discipline. The charts below are DAILY bar charts.

I also added to Nova Royalty Corp (NOVRF) as the copper sector is getting smashed again too, and since I like buying things on sale while I don’t yet have a full position, today is as good a time as any. I intend to keep adding to NOVRF and acquire a few other copper miners, as well as some uranium stocks since they are pulling back hard also. In fact, even the general stock market is starting to weaken, something I have been patiently waiting for, as I expect it to lend some strength to precious metals once we see a weak month or two in the S&P500 and Nasdaq. Stocks I’m looking for buy signals on over the next few days include URNM, CCJ, URPTF, DNN, NXE in uranium, and WRN, COPX etf, IVN.TO, TGB, ATUSF, and a few others. Looking out a few weeks, the TAN (Solar etf), and PBW (Wilderhill Clean energy etf) might be setting up for buy signals soon on the WEEKLY charts, and SPCE (Virgin Galactic) could be doing the same, after losing close to hlf it’s value in just the last month! I posted a chart of SPCE to show how quickly something can drop on a “buy the rumor, sell the news” situation. Just after Richard Branson took his own service to visit space, SPCE stock started dropping like a stone, the opposite of what most investors would expect!

After a good start to the year, it’s been a tough stretch the last couple months. It’s part of the game, and at times like this we must remind ourselves that a solid game plan with the discipline to follow it, are what determines our overall success in trading and investing. Drawdowns are just another part of the process, it’s how we manage them that matters. Let our well-placed stops take us out when a stock gets there, it’s about risk control, not opinions or emotions at that point.