Sold PSLV at loss to move to Miners

July 15, 2021

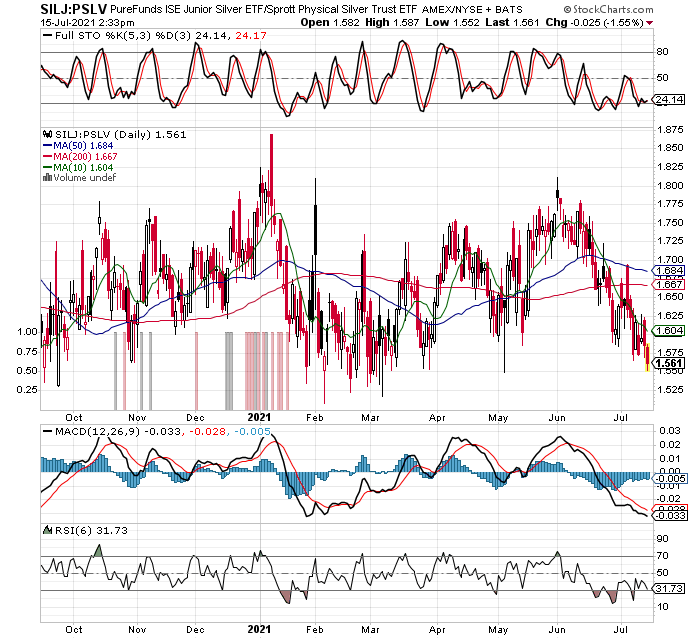

While I am not stopping out of PSLV etf (Sprott Physical Silver etf), I keep an eye on the ratio between the miners and the physical metals for times like this where one outperforms the other drastically. It can be a good time to make the switch to a different, but related investment. From the chart below you can see that physical silver has been doing much better than it’s miners for awhile now. I will take the bet that this ratio is overdone and soon we will see the relationship reverse like usual. In this case I’ve decided to liquidate my PSLV holdings and will use the proceeds to get more invested in silver and gold miners over the next few days. The first stage, the sale is complete, now I just need to get the money back to work while miners are trading at low prices. The list of prospects has been mentioned here many times already, like I have already added some more MUX (McEwen MIning) today, and though not a silver miner, I added copper royalty company NOVRF (Nova Royalty Corp) on this decline today. I might even put the proceeds into an etf like GDXJ or SILJ, if individual names don’t offer up a buy opportunity or start to move higher without me. I also have had a bid in all day for more WLBMF shares (Wallbridge Mining), and Canadian junior gold explorer. Here is the ratio chart of SILJ:PSLV, note it is “oversold” on the daily stochastics, but know the weekly chart stochastics are as well.

SILJ:PSLV ratio shows how silver has outperformed silver miners since June 1

I am also close to stopping out of a couple junior miners, and will keep members posted if I sell. I will continue to add in the pullback to MUX until I get a full position, it’s almost there. I’m still looking to add to every name I have been buying recently, it just depends on which one is offering up the best opportunity each day. Members can see the loss I took on PSLV today, as well as my revised stop levels, and new total position sizes in the tabs above.