November 14, 2024

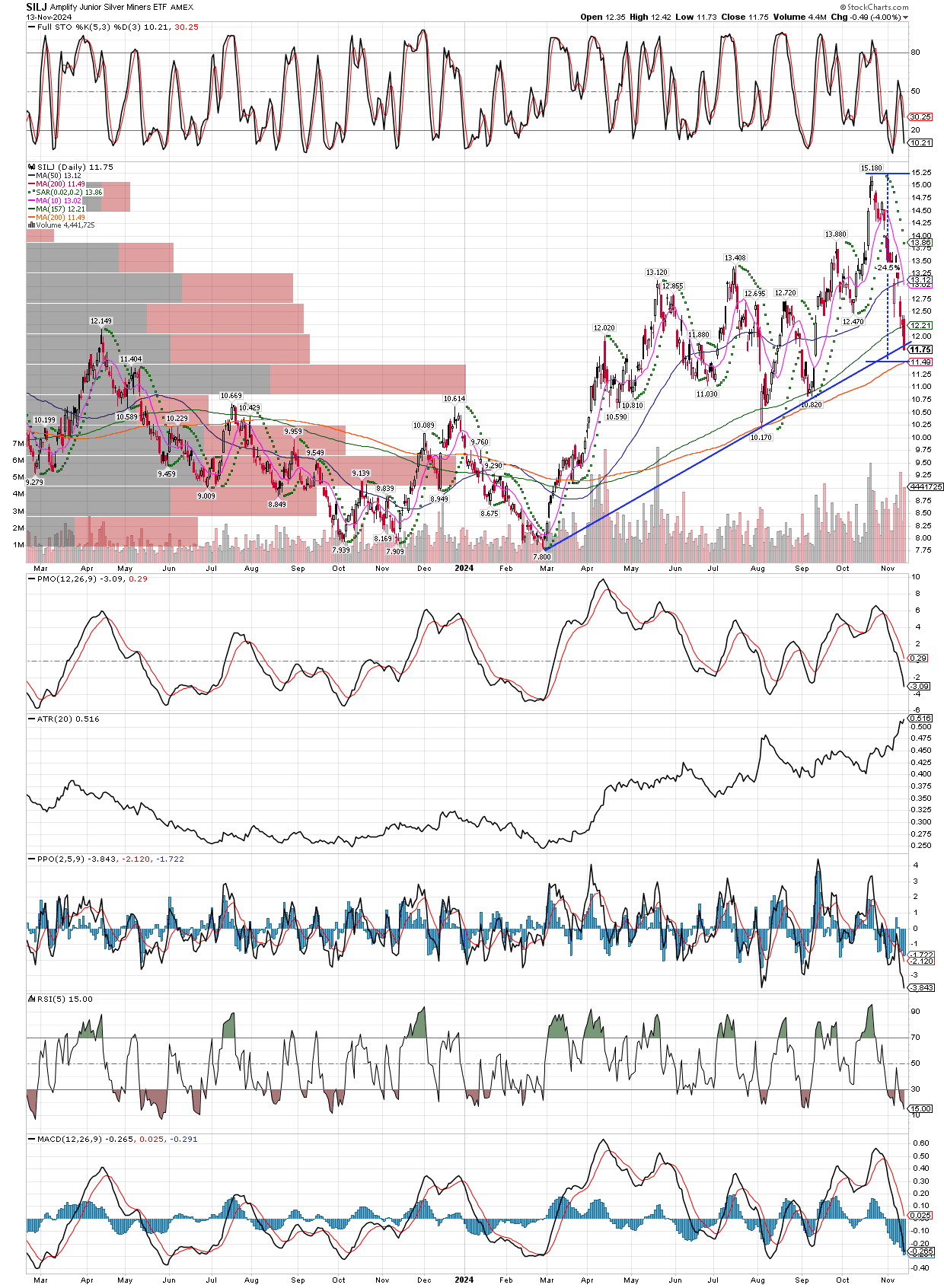

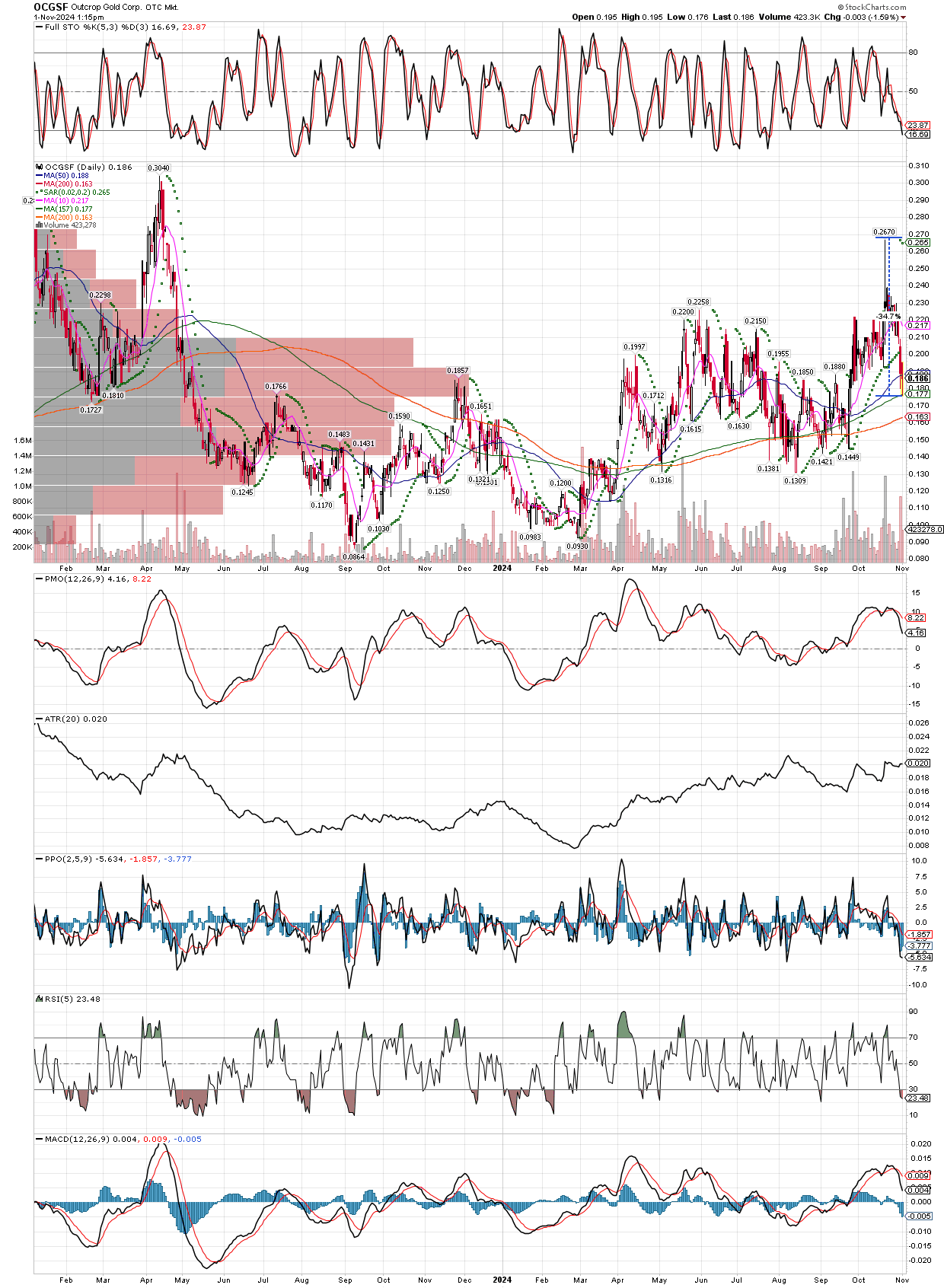

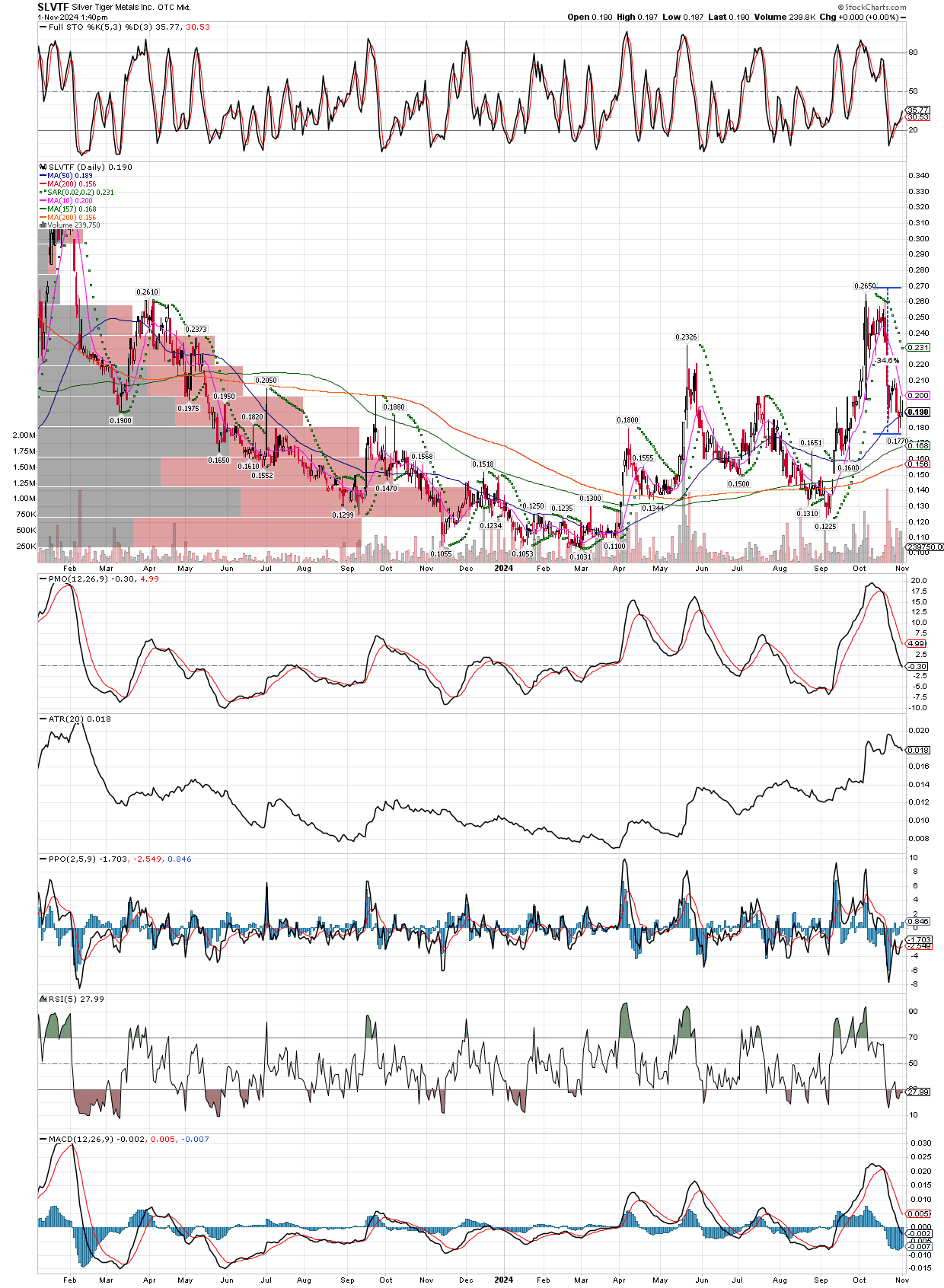

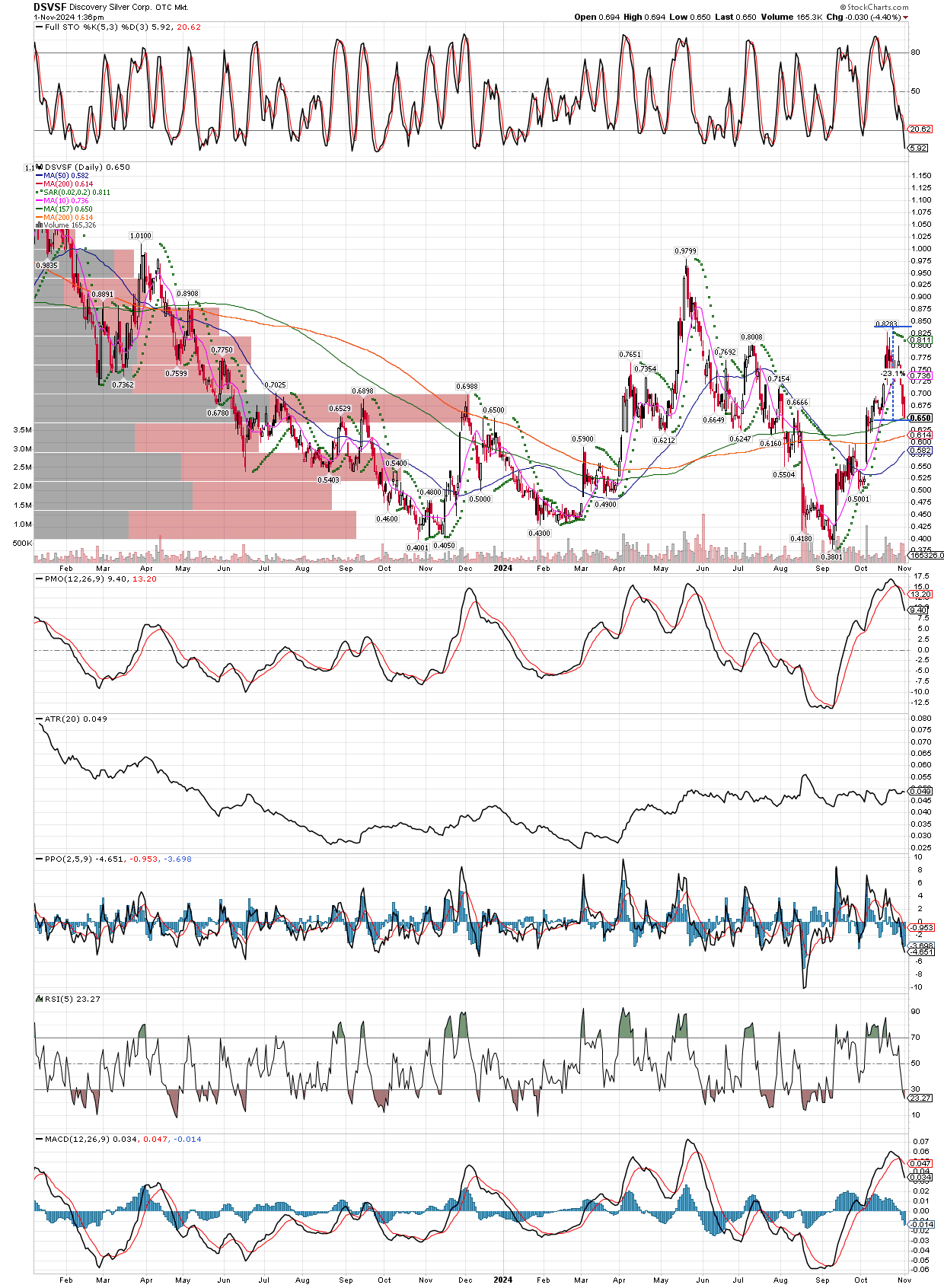

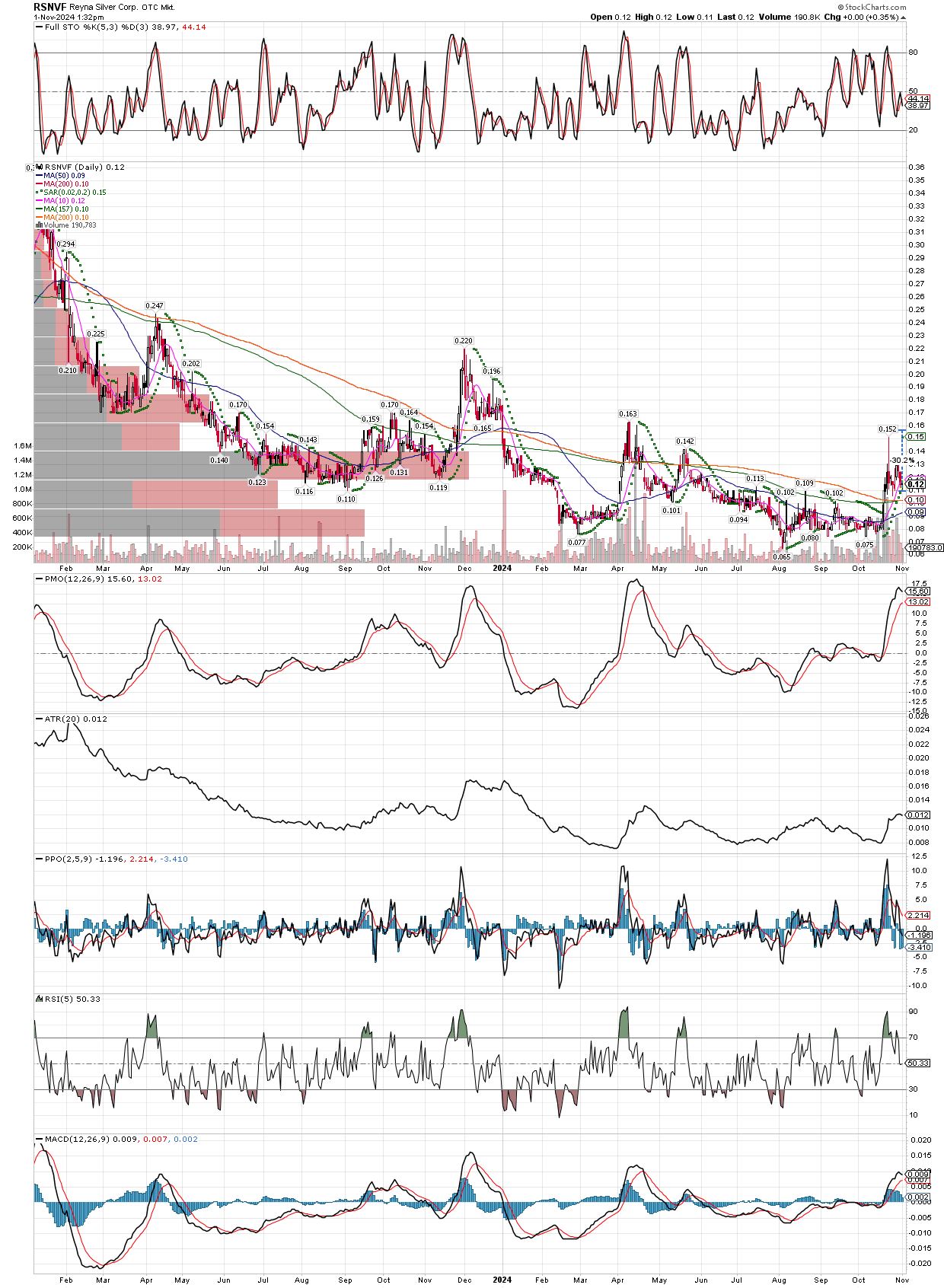

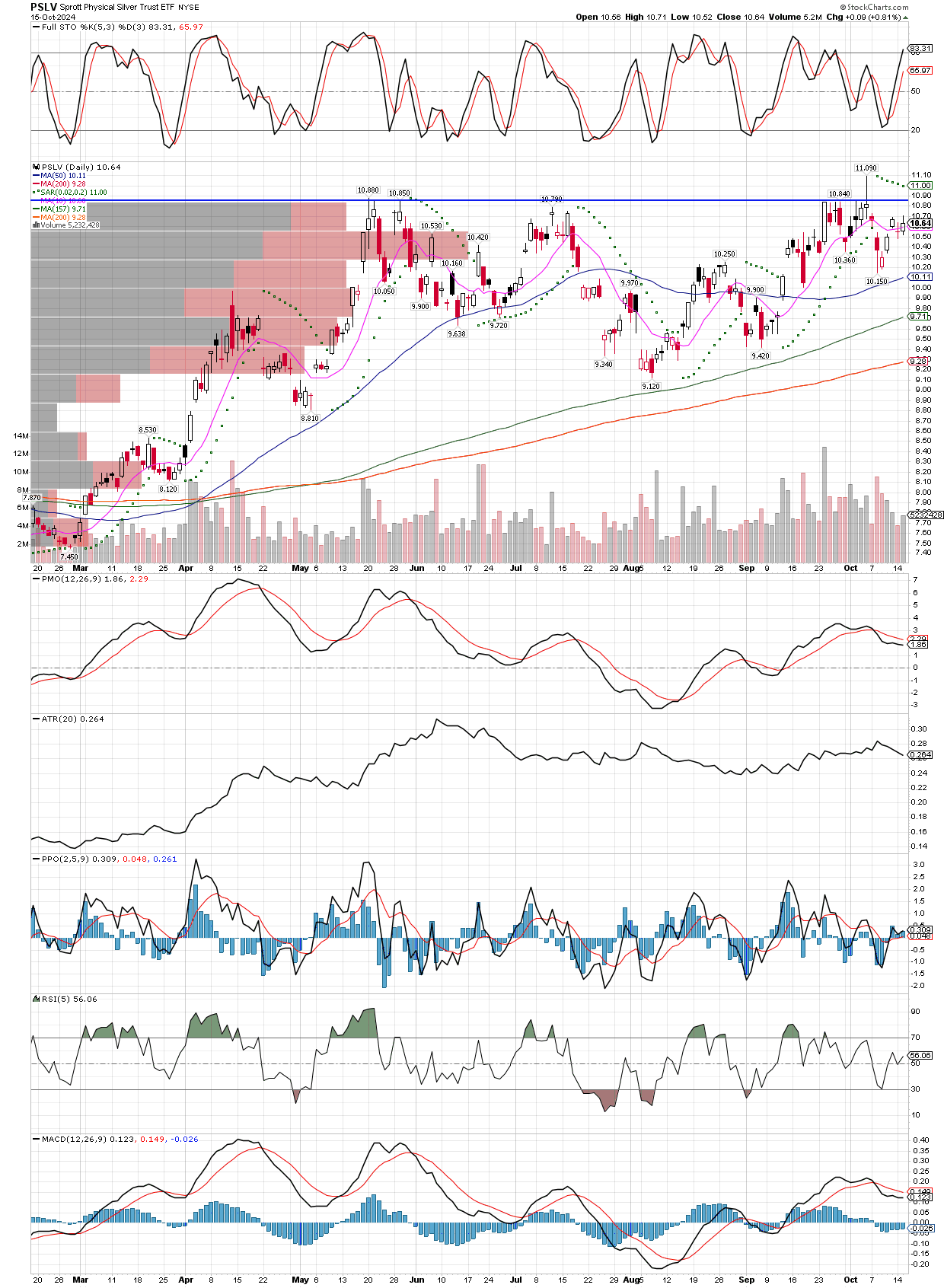

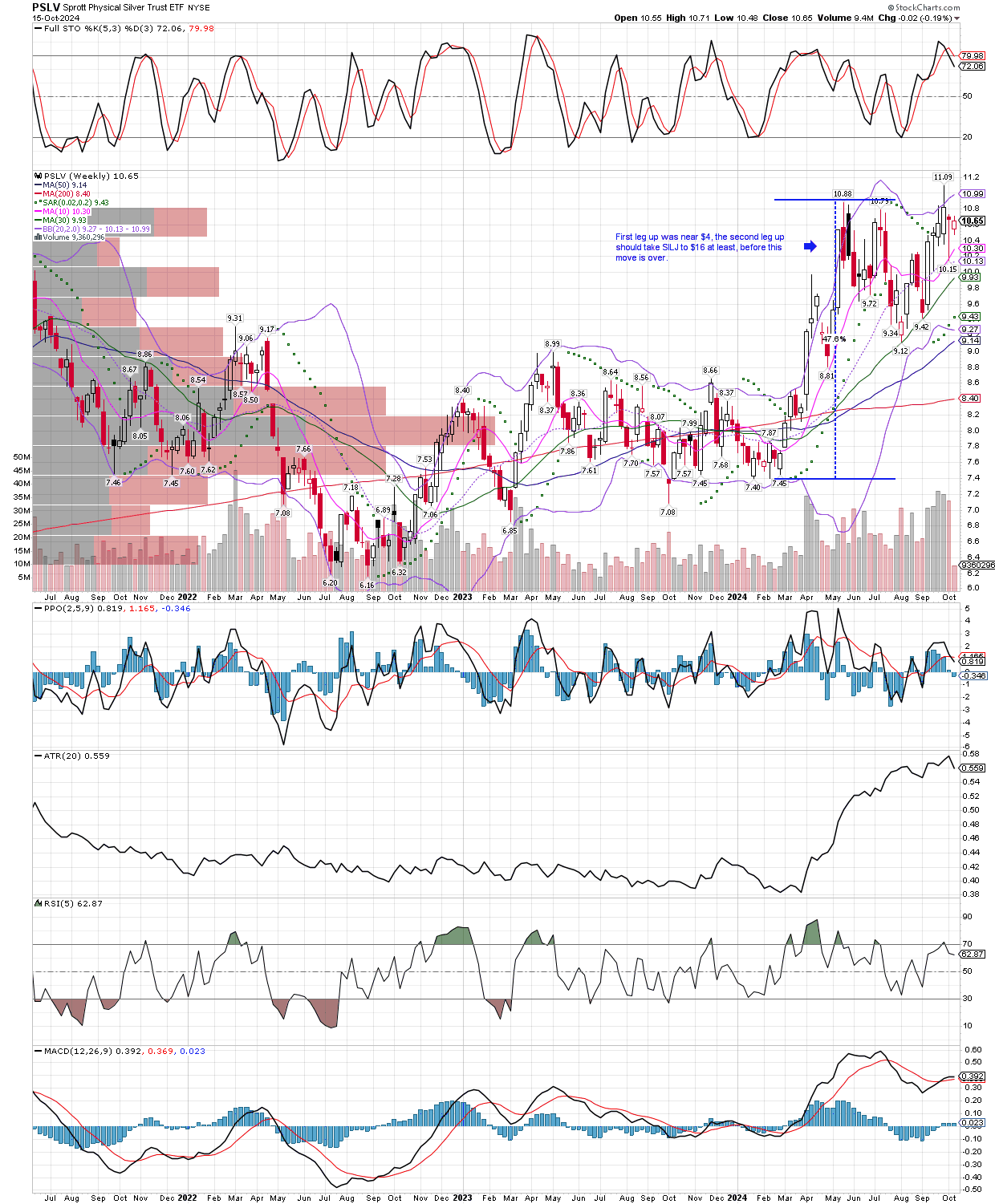

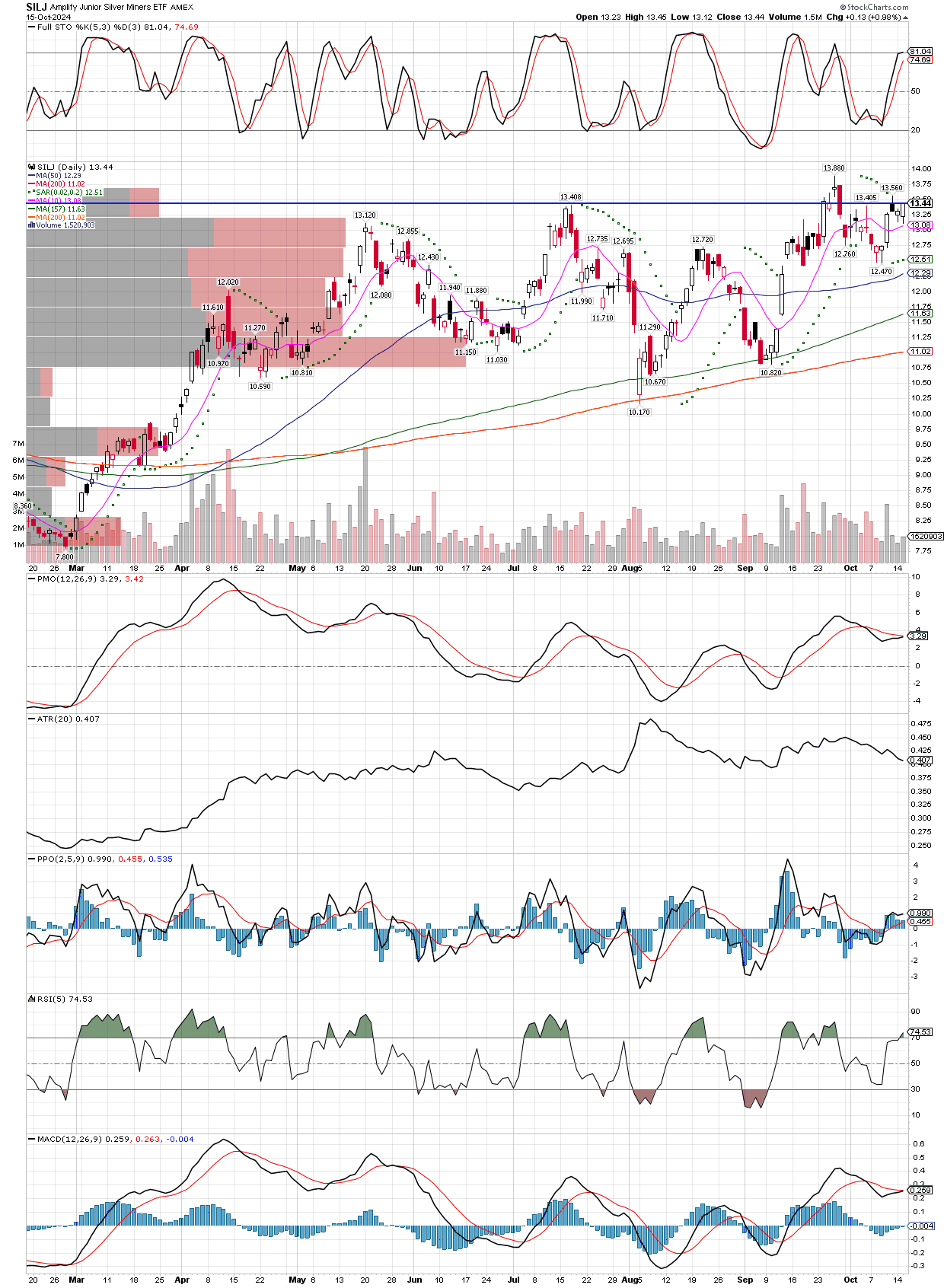

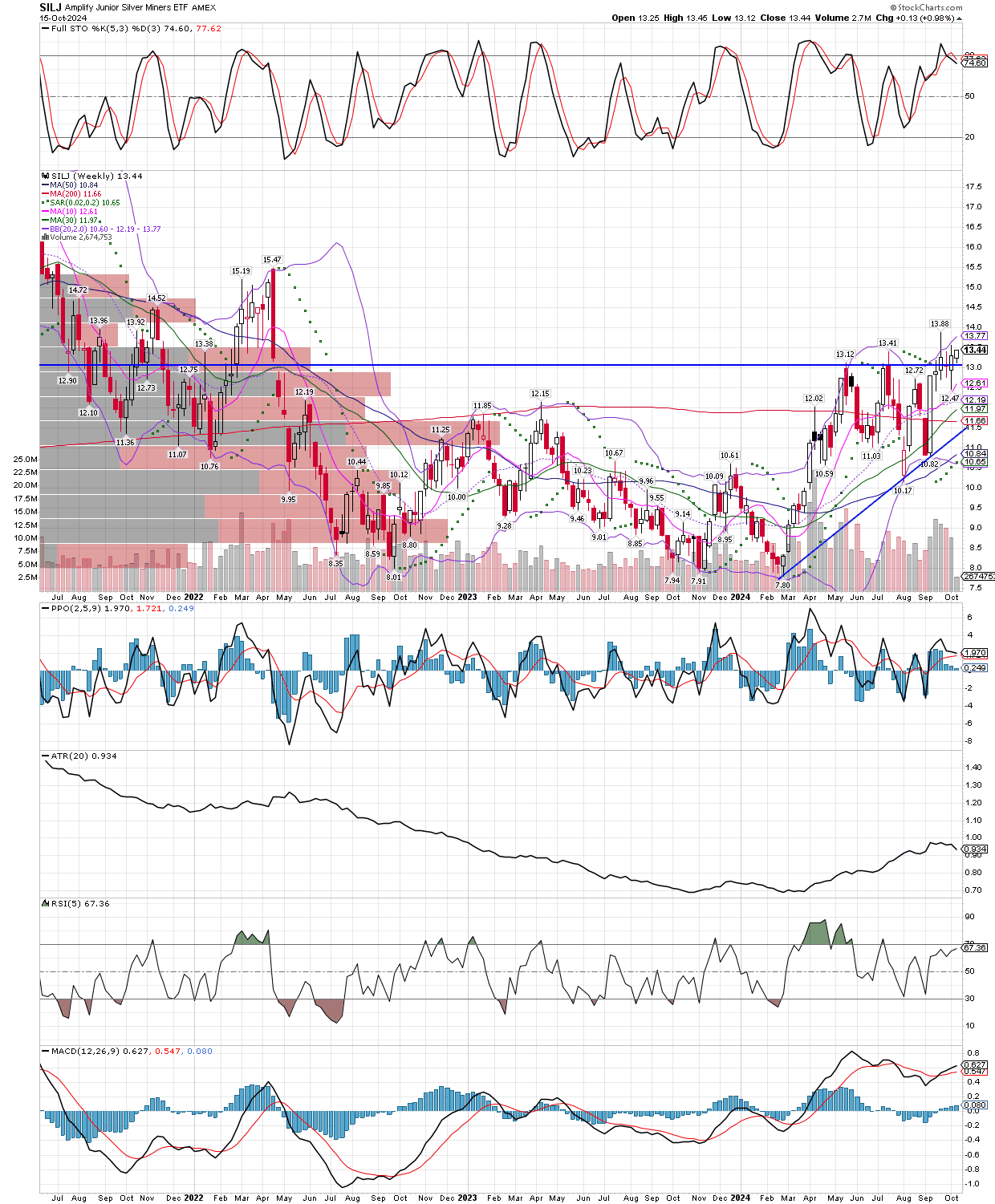

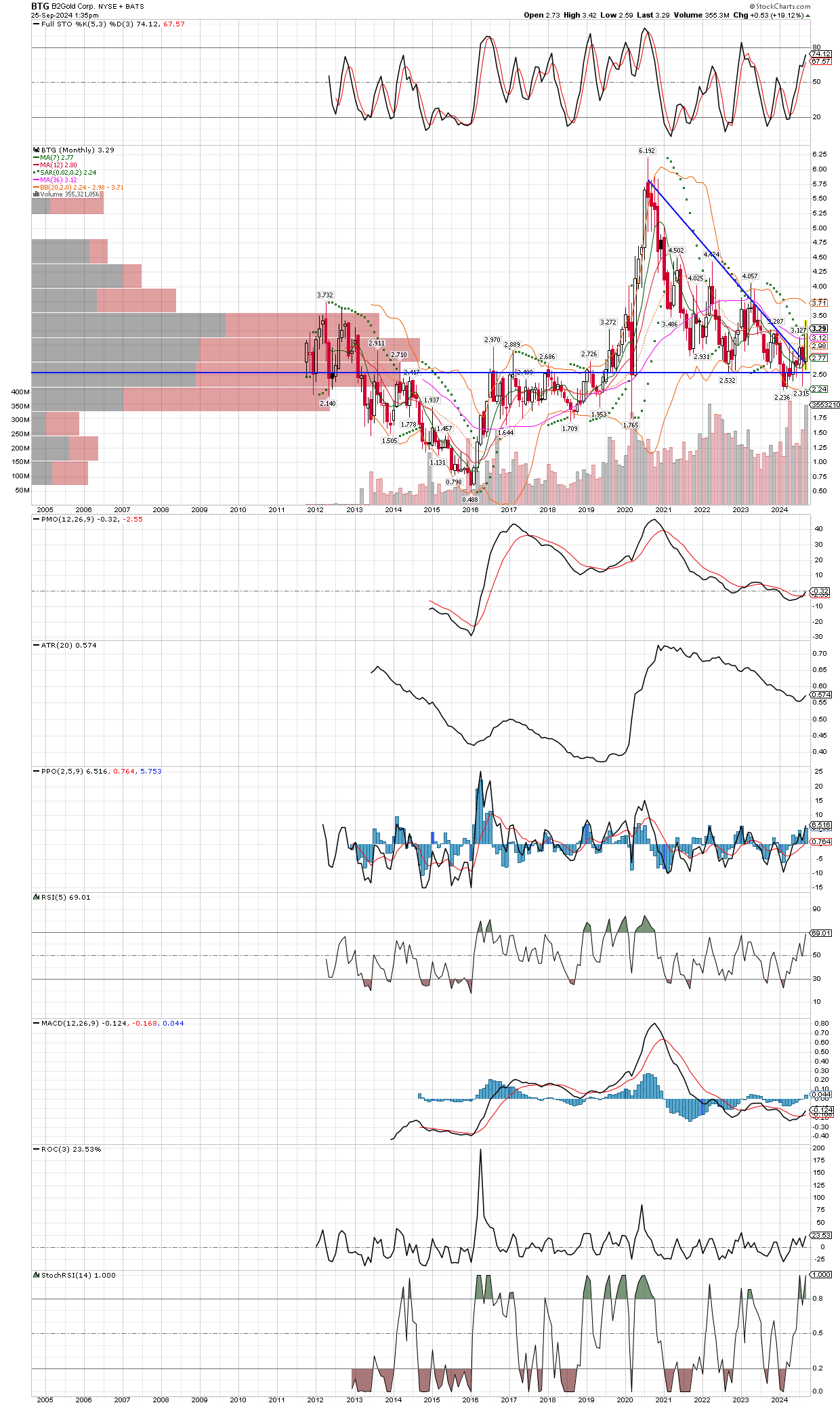

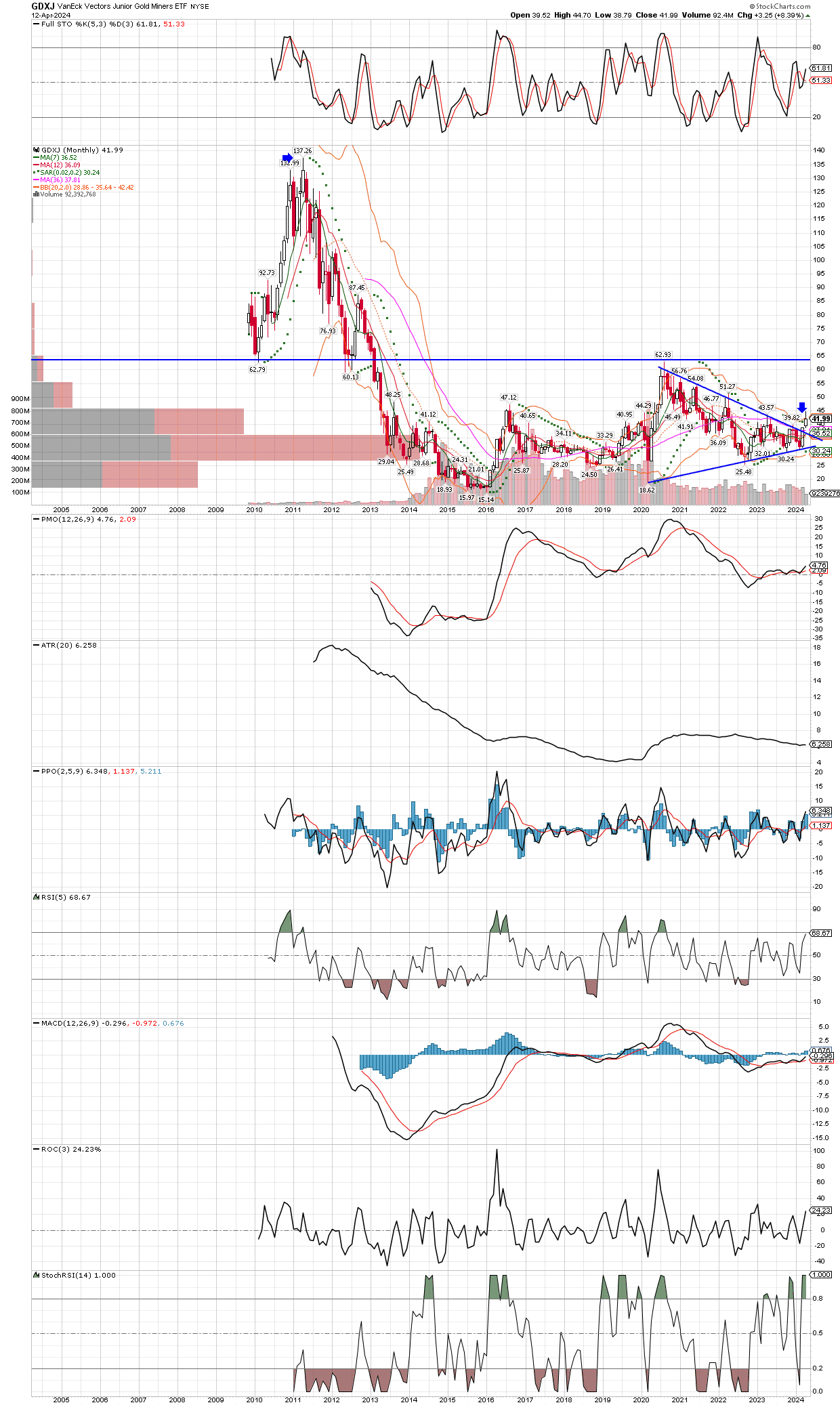

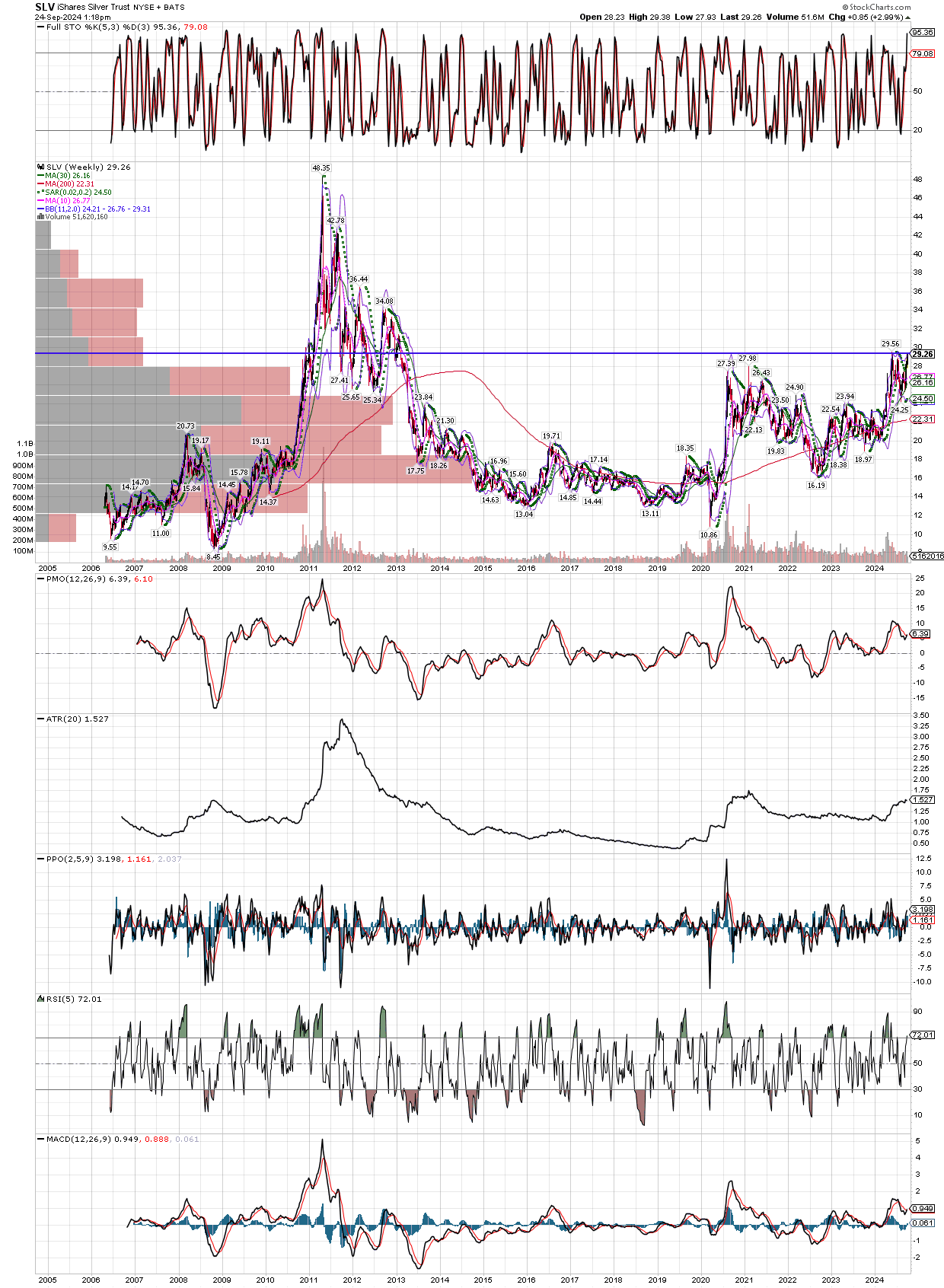

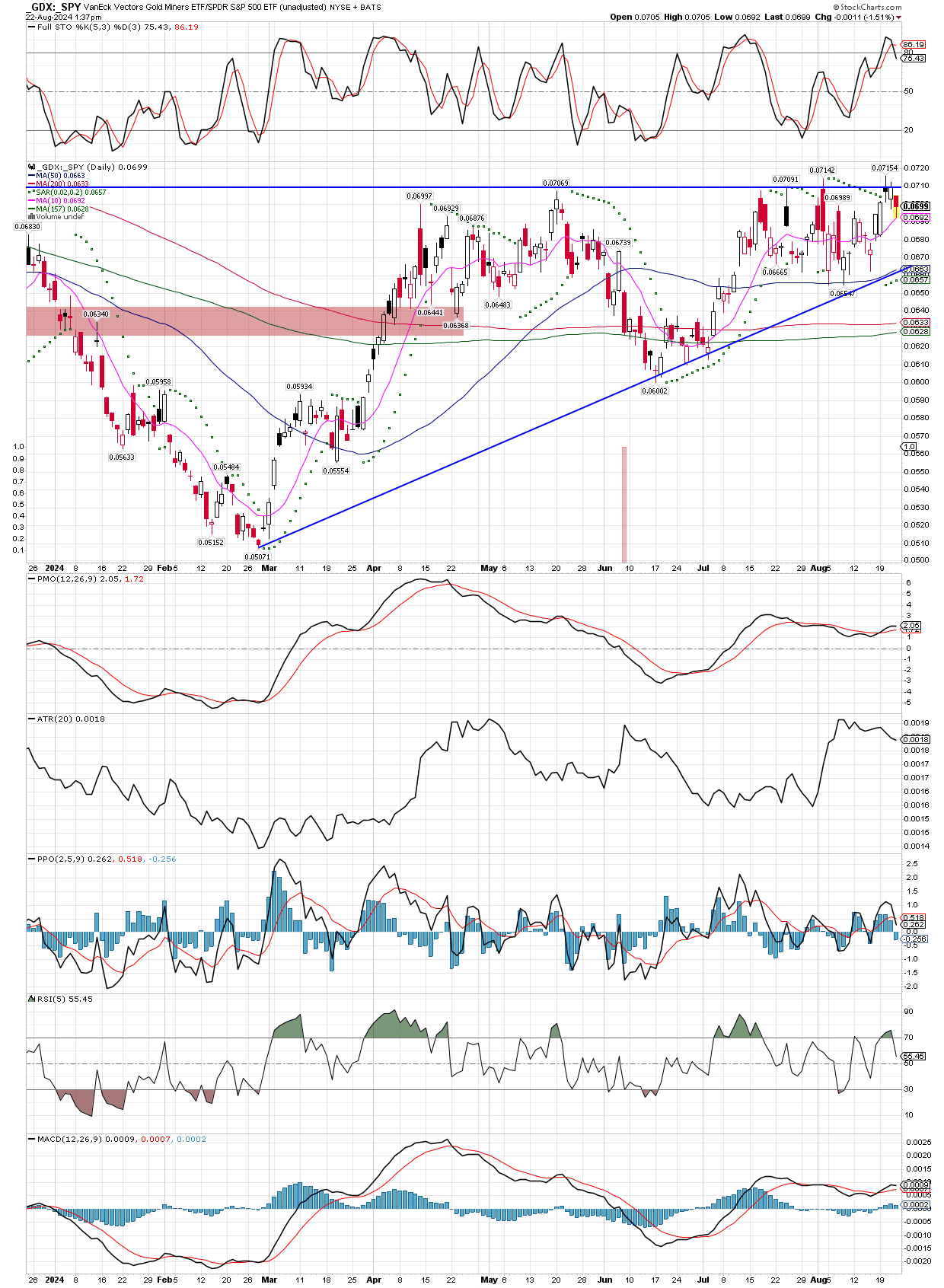

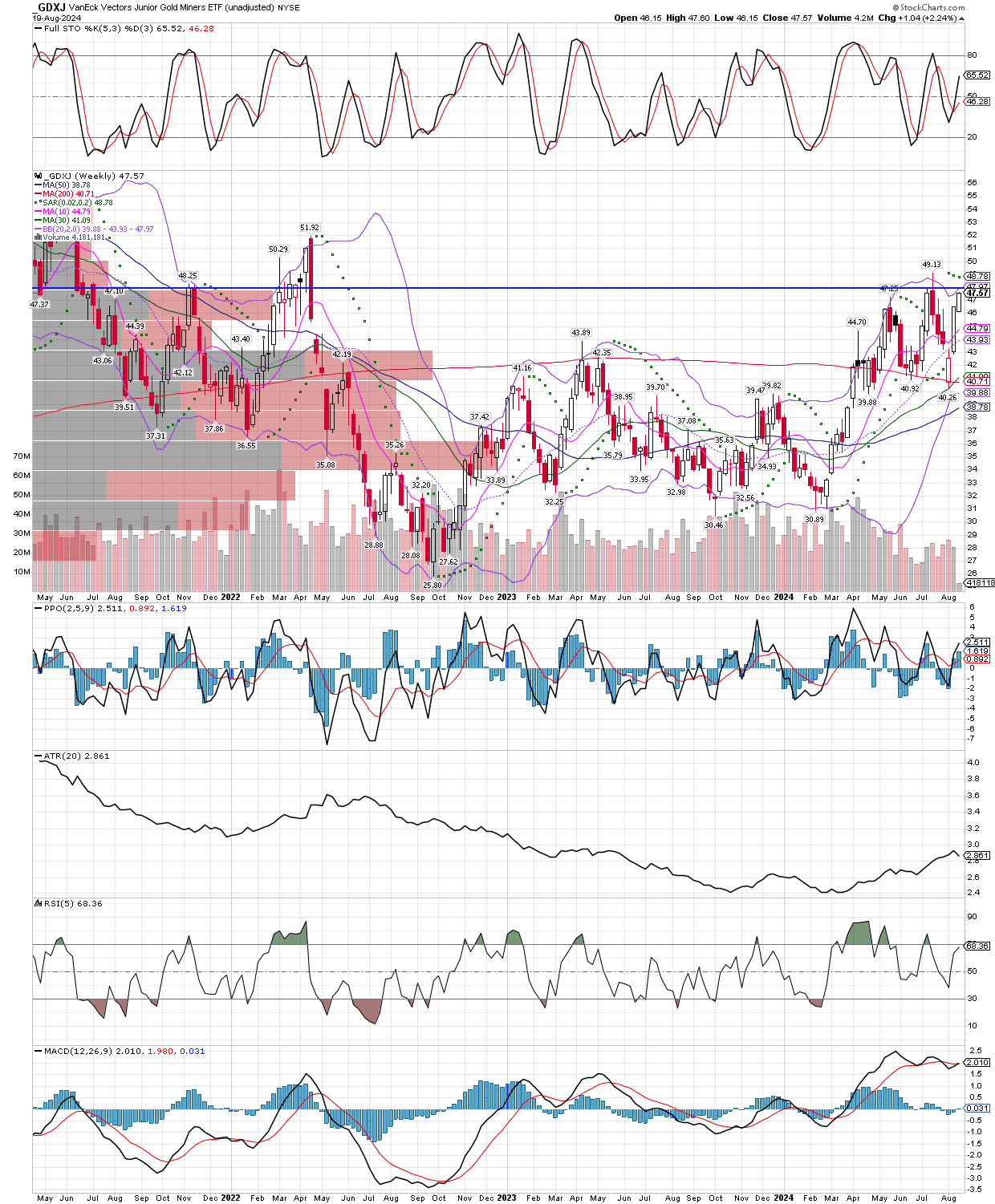

As I type about 90 minutes before the US markets open, SILJ looks like it will test and possibly slightly break its uptrend line, 200 day, and 200 week moving averages all at once! The excuse being used it that the Trump win puts the markets back into “risk-on” mode, and that can be seen in bitcoin rocketing to new highs, and the general stock market making new highs as well. In the face of that, we see copper stocks (COPX), and precious metals miners getting smashed. So, the question is, has the bull market in commodities and especially gold and silver ended. If one thinks so, that these recent sharp moves are going to continue, then they should make drastic changes to their portfolios, but if one is like me, and thinks these moves are just short term reactions to a Trump win and nothing will change in the overall policy of dollar destruction (more wars, more spending, etc), then this should be a good area to accumulate more heavily the miners and their metals. I am leaving copper aside for now, in fact I sold TGB and LBCMF this week to take profits, but only because I think we are more likely to see negative economic data come out soon, as is often the case early in a new presidency. The winner likes to cram as much negative news into the first year of his term, so that they can blame the other guy and lower expectations, then they can easily beat this expectations as their term winds up, and claim how well they did!

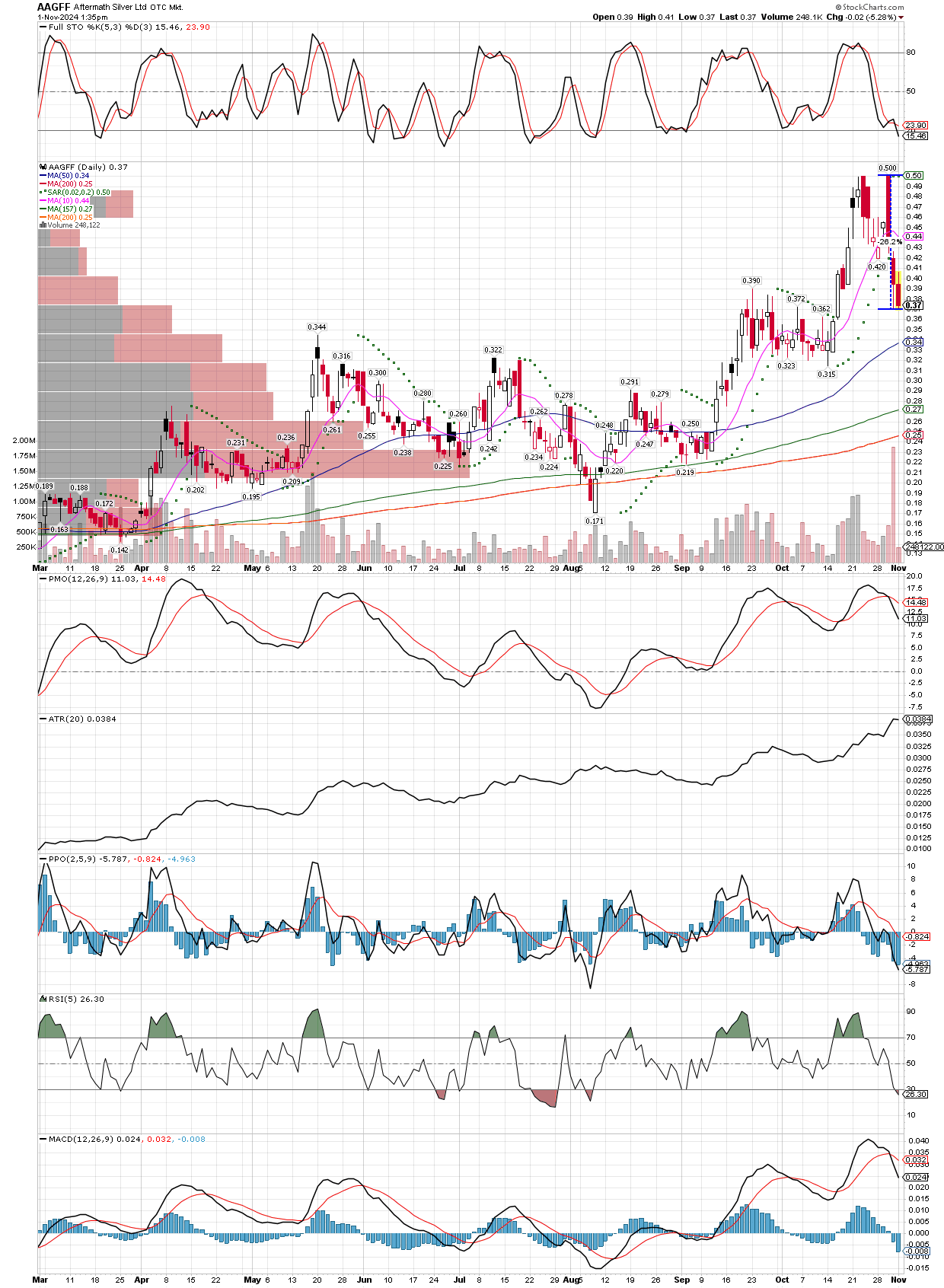

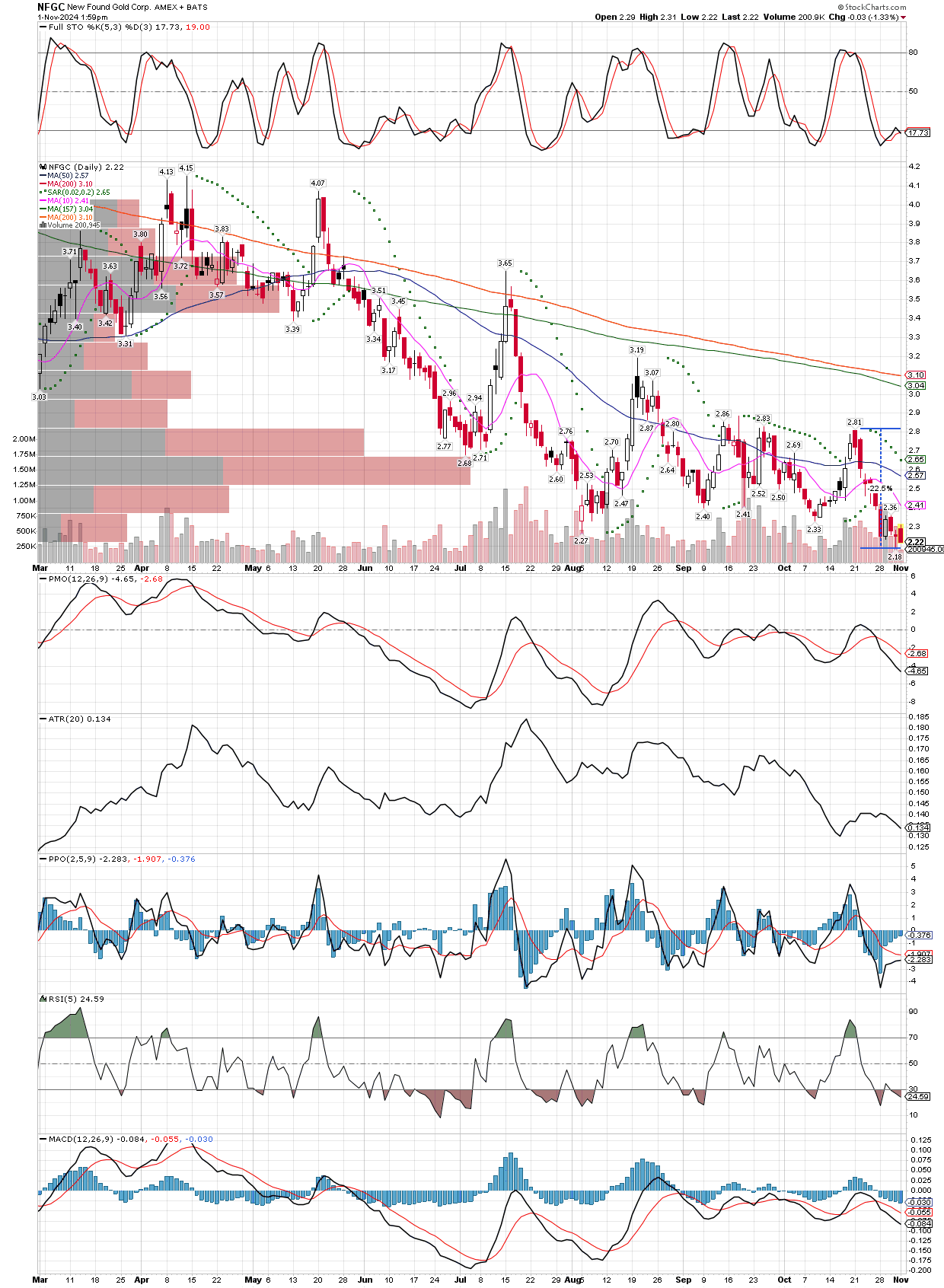

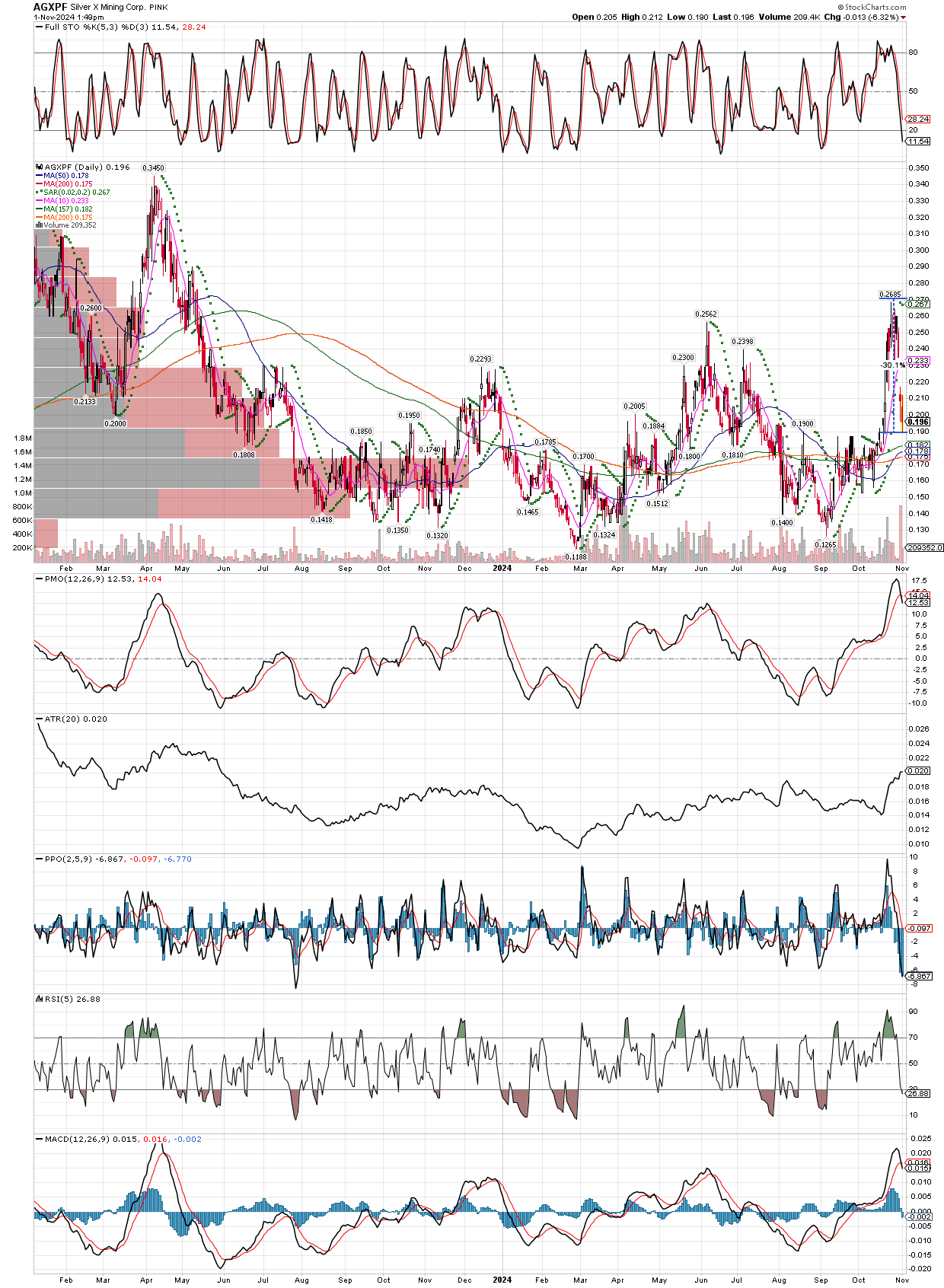

I am taking this selloff as a buying opportunity, with SILJ down near 25% already in three weeks (and 11% just this week so far). Recall that I have pointed out corrections in bull markets are short and fast, and can cut deep, all of which we are seeing now. Prior to the bashing, gold and silver miners were sporting very nice charts, making multi-year highs, and silver itself was making 14 year highs, while gold continue to make all time highs. These trends don’t break easily, so we should expect a good-sized bounce soon. Does that mean I think the fast rise in prices we saw will return quickly, and the bull market will be back on in full force? No, it could happen that way, but more probable is we get a bounce, then they sell off again, then rally, as they go mostly sideways for awhile (4-8 months?), before the bull is ready to re-exert itself with force. In any case, declines like this one that occur in bull markets, typically are places one wants to add exposure. Below I will post both the daily and weekly charts of SILJ, keep in mind trend line averages are never lines in the sand to me, they are just loose areas where we can look for support, resistance, etc. All the names I have mentioned in recent articles and even a few new ones like ASM, which is another miner that has just pulled back 33% after making new multi-year highs, are stocks I am buying, including SILJ itself. Stay focused, and take advantage of some of the sales happening right now!