February 17, 2024

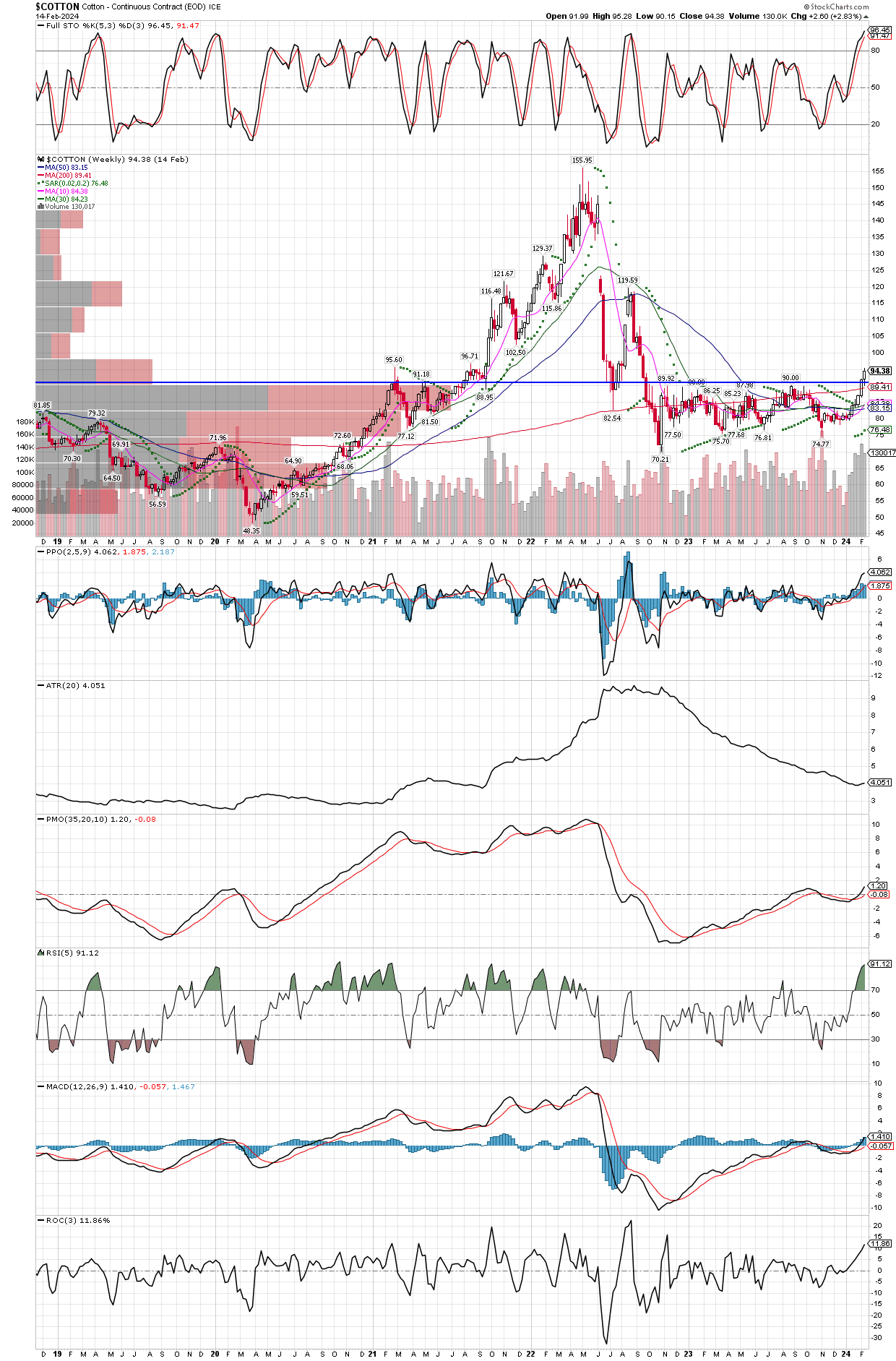

I have been waiting patiently for cotton to rise and hold above the 90 area, which has now occurred. While it has overbought technicals on the daily and weekly charts already, we will be looking to buy cotton futures into a decline to around 90, with technical indicators well out of overbought, but preferably into oversold zones.

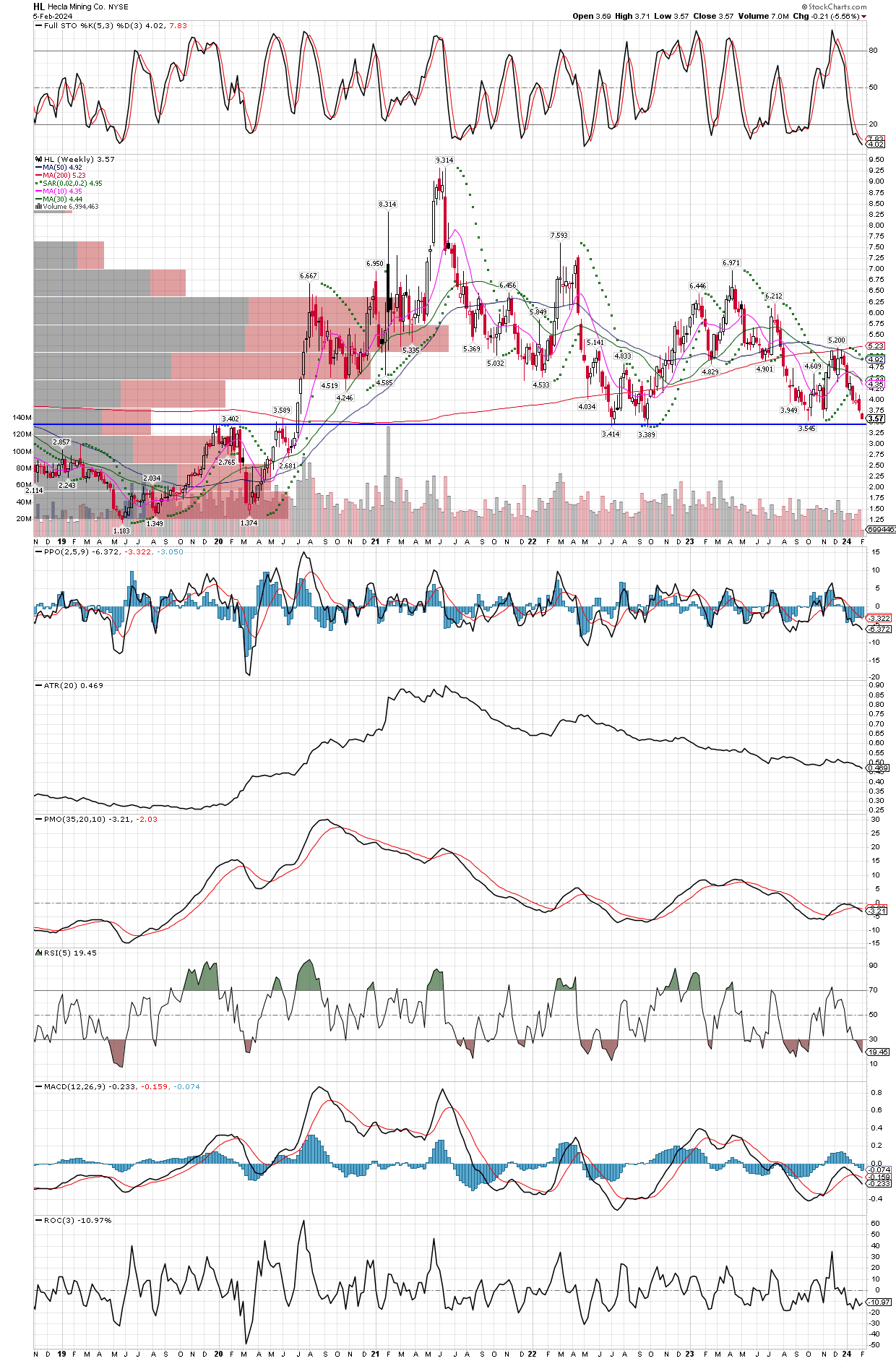

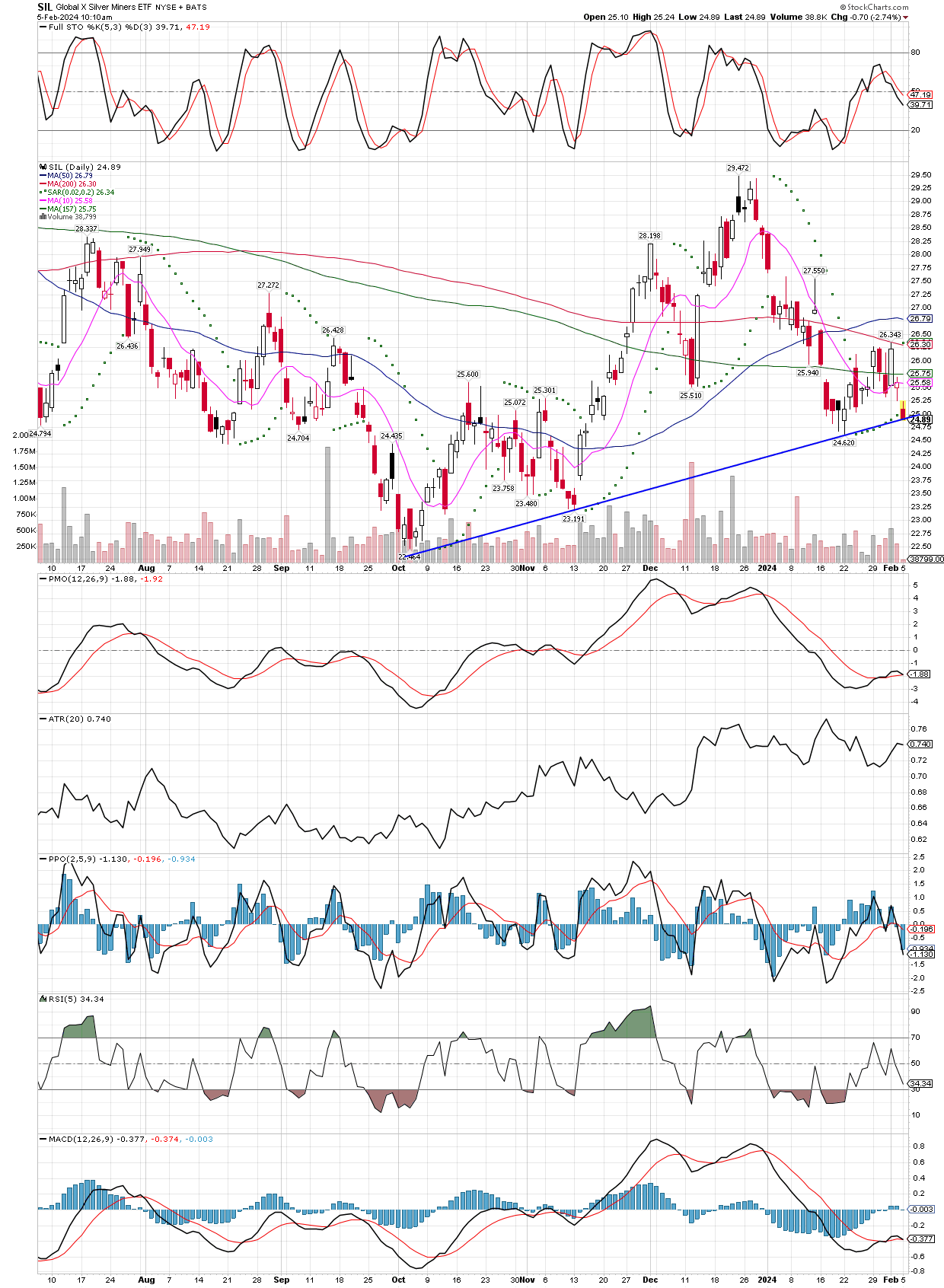

Aside from looking to enter cotton and the MJ etf, we also made some small additions to our mining positions, while they are still weak.

February 6, 2024

February 5, 2024

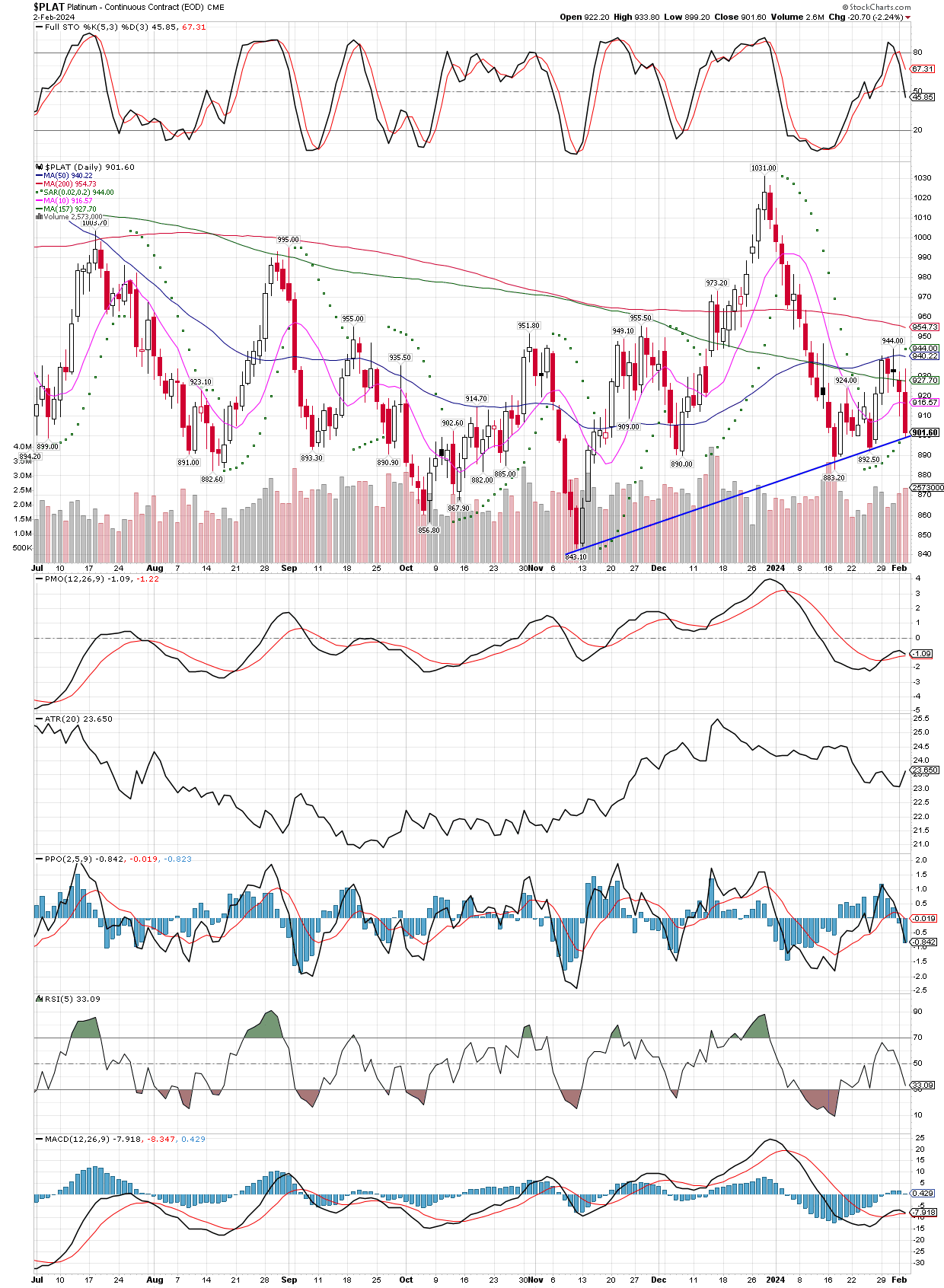

February 2, 2024

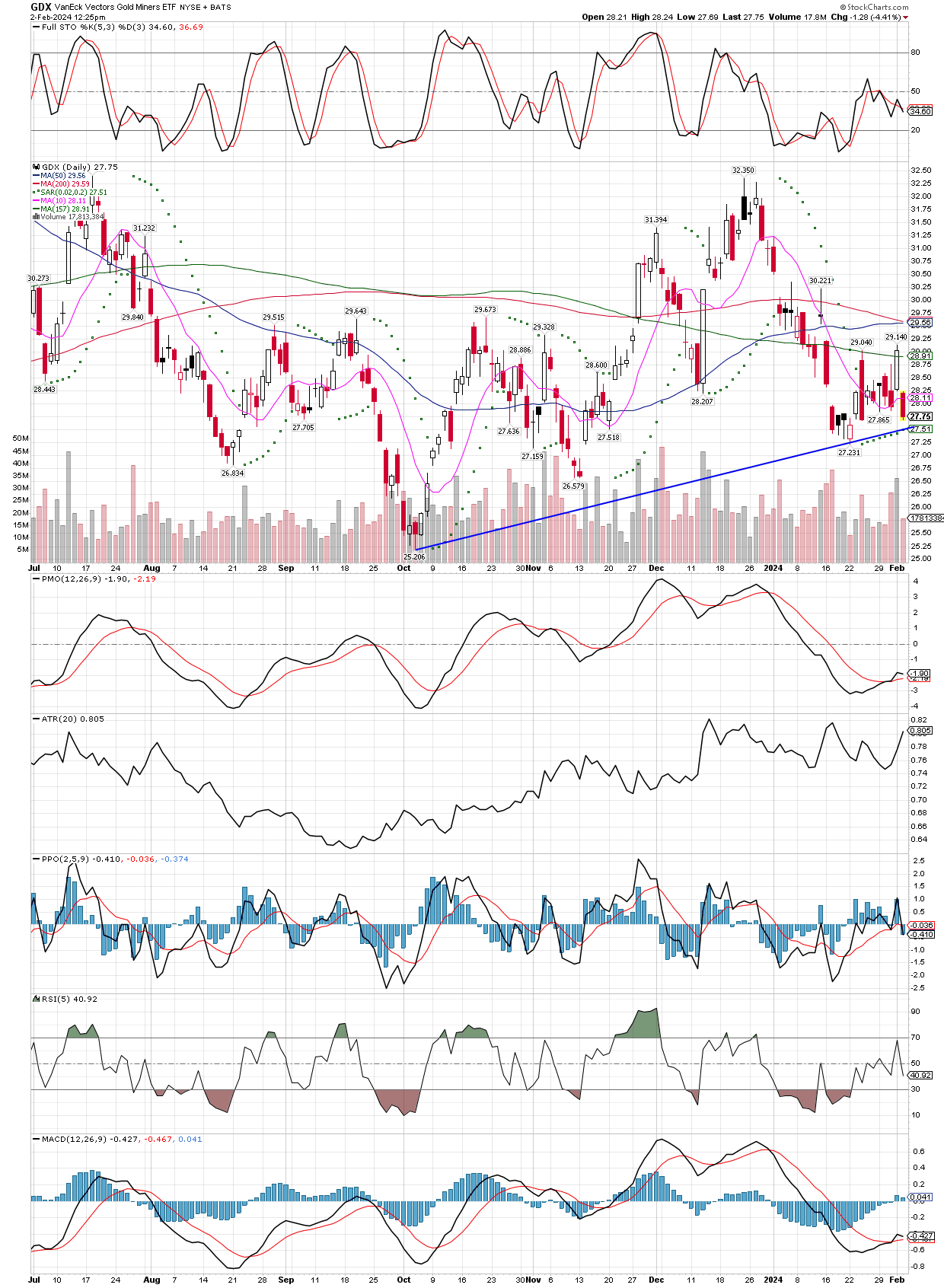

Just a quick daily chart of the GDX, they say a trend line isn’t valid unless it has at least three points of contact. I took the liberty to draw one, wondering if the third contact it is nearing now, will be where it halts it’s recent decline? In the meantime, I took advantage of the pullback today to nibble here and there on several of the holdings in our portfolios, keeping my overall TR fixed as a percentage of my portfolio. Essentially this give me less room on the downside before I have to stop out, because I have the same amount of dollars at risk over larger position sizes, but it also gives me more shares to ride higher if I am correct and they change course soon.

February 1, 2024

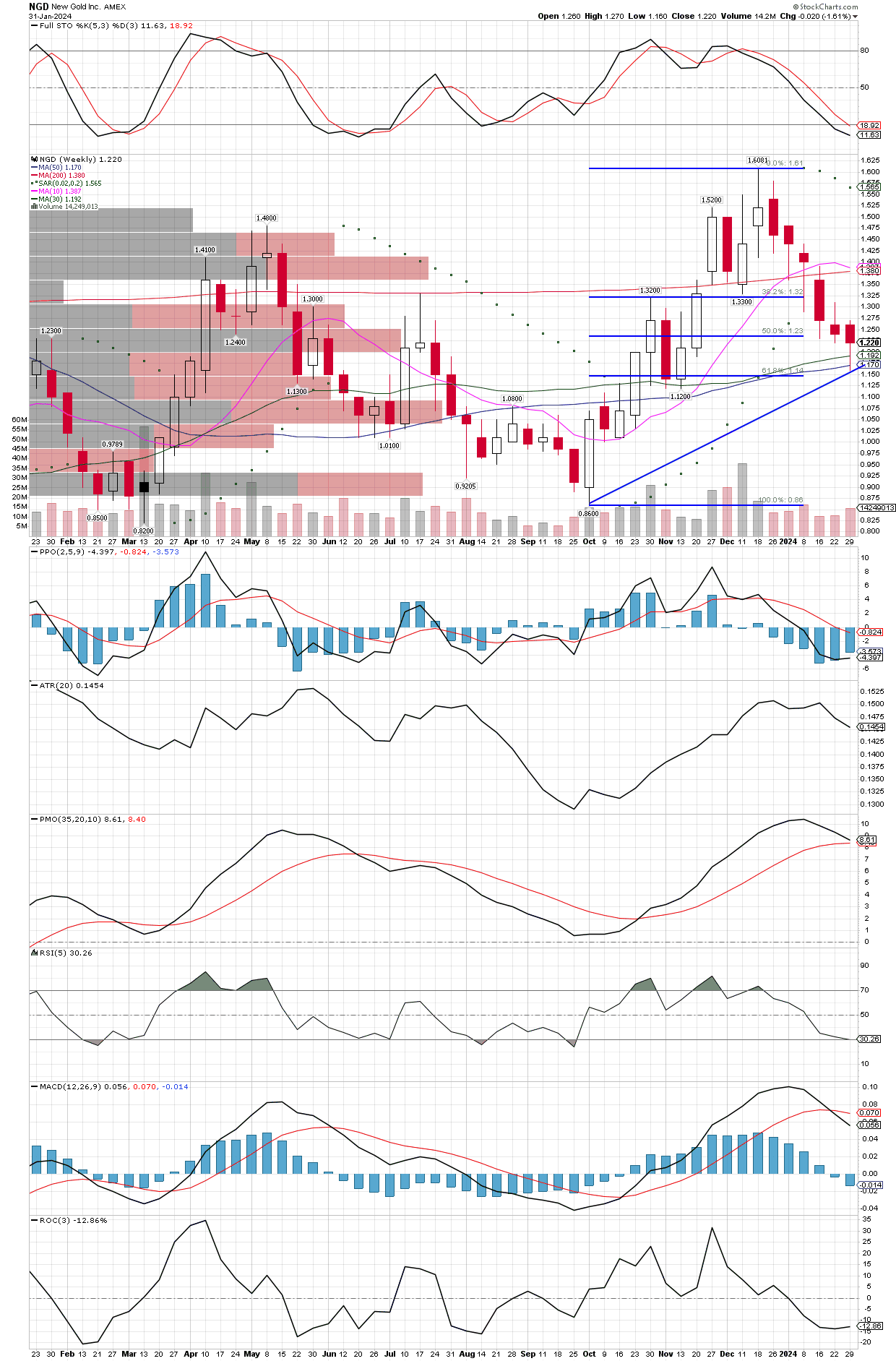

New Gold was bought yesterday before the close of trading, below are both daily and weekly charts. In the current price zone seems like a good area for the stock to find support, both the trend and the stochastics suggest. I also like how the moving averages are shaping up on both charts. Essentially, we are buying a strong stock after a good-sized correction, realizing that metals prices (fundamentals) will still be the most important factor driving the stock price. I consider this a mid-cap producer with exploration potential that could increase reserves.

January 31, 2024

Yesterday I shared the portfolio changes, but when I want to clarify how I invested the SILJ proceeds. The equal-weighting I mentioned was within similar companies, the mid-caps vs. junior explorers, but I invested 75% of the funds into the mid-cap producers, only 25% in the junior explorers, and in each group the fund were equal weighted in each miner. So the bigger miners split 75% among them, the juniors only 25%, and I chose to equal-weight the positions in each, meaning the mid-caps’ positions are 3X more each than the amount invested in each junior explorer. I figured the 75/25 split was appropriate to compensate for the higher risk in the juniors.